|

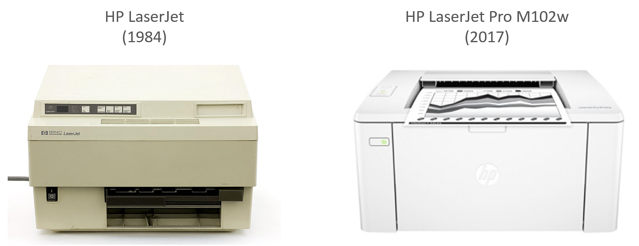

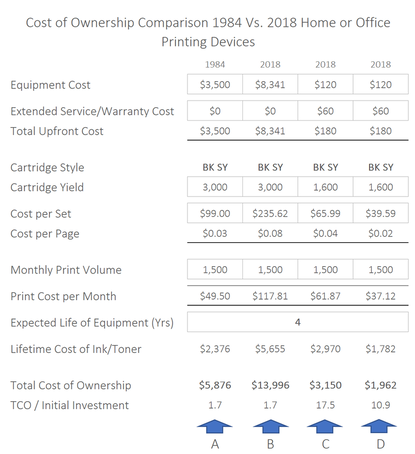

In the second half of the 1980s, desktop laser printers became widely available as the personal computer revolutionized our lives, first at work and then, later at home. To begin with, PCs and printers were expensive and, by today's standard, printing speeds slow and print quality poor. Still, in comparison to the typewriters and dot-matrix printers they replaced, laser printers were a huge advance. The Hewlett Packard LaserJet printer introduced in 1984 cost $3,495 which, in 2018 dollars, is the equivalent of almost $8,500. It printed at 8 pages per minute, with a resolution of 300 dpi and was quiet, at <55dBA compared to the dot-matrix printers and typewriters it replaced. Fast forward to 2018, where it's now possible to purchase an HP monochrome laser printer, such as the LaserJet Pro M102w, which prints at up to 1200 dpi, up to 23 pages per minute, and can be purchased for around $120. So, it prints at almost 3x the speed, at 42x the dpi, and costs only 1% of what it did in 1984 equivalent dollars! 300 dots per inch (DPI) horizontally and vertically equals 90,000 dots per square inch. 1,200 DPI vertically and horizontally equals 1,440,000 dots per square inch, or 16x the print density! We thought it would be interesting to compare the 1984 value proposition to the present day. As we just explained, the HP LaserJet printer in 1984 at $3,500 is the equivalent of $8,300 in 2018 dollars. So, the current M102w printer at $120 is a little over 1% of the price of the 1984 device, and it comes with substantially higher performance characteristics. However, when we compare the total cost of ownership (TCO) in 1984 for a LaserJet printer and in 2018 for a M102w LaserJet Pro, an interesting picture emerges. In equivalent 2018 dollars, and as illustrated in example B above, the LaserJet, during 4 years of printing an average of 1,500 pages per month, had a TCO of around $14,000 or 1.7x the inflation adjusted purchase price. The M102w printer (using OEM brand replacement cartridges) has a TCO (Example C) of just over $3,000 (75% less in equivalent dollars) but, that TCO now represents over 17x the original purchase cost. In other words, the cost of the equipment has fallen at a much higher rate (99%) than the cost to print a page (47%). Note, in making this comparison, it's important the cost per page metric is considered, not the cost per cartridge because the page yield of the cartridge has been reduced by nearly 50% (1,600) compared to the original LaserJet cartridge with 3,000 pages. So, although the M102w cartridge cost is 70% lower in equivalent dollars, the cost per page is only 47% lower. Perception of Risk with Re-manufactured CartridgesBack in 1984, the ratio of the cost of the ink and toner cartridges to the cost of the machine was around 3% whereas today it's 55%. Over a projected 4-year lifetime, the ratio of the total cost of ownership (TCO) to the initial purchase cost was 1.7 and is now 17.5. Far more is spent nowadays on replacement cartridges in relation to the initial cost of the machine.

Back in 1984, it was understandable that owners of relatively expensive printing equipment would be less likely to take a perceived risk with their equipment they may have believed they would be taking with the use of third-party replacement cartridges. The perceived risk meant putting a piece of equipment that cost $8,500 (in today's dollars) potentially in harms way. Today, in our comparative example, the printer investment potentially at risk is a little over $100. Because this upfront investment for an entry level printer is virtually insignificant compared to the amount that had to be invested in the 1980s, the perception of risk resulting from the use of lower cost third-party cartridges is also virtually eliminated. Of course, not all printers are as inexpensive as $120. Higher-end machines with much higher duty cycles cost a lot more than the lower-end machines. So, just like it was the case back in the mid-1980s, it's still more likely for a consumer to be concerned about the use of third-party consumables on a printer that may have cost five or ten thousand (2018) dollars than one that cost a little over $100! However, the sophistication of the aftermarket manufacturers and the quality of their products are at a very different level compared to when the remanufacturing industry emerged in the late 1980s. Improving Quality of Aftermarket Options When the HP LaserJet came to market in 1984 there were no alternatives available in terms of replacement toner cartridges. The only option was the $100 original brand cartridge from Hewlett Packard. This situation led to the development of a cottage industry which spotted the opportunity to offer refilled toner cartridges at significantly lower prices than new OEM brand cartridges. However, the trouble was, a big trade was required in terms of a reduction in printing quality and reliability that came with the refilled cartridge and its lower price point. In those early days of the emerging market for laser printers (later followed by ink-jet printers) there were few high-quality sources of parts and supplies necessary to support high-quality aftermarket ink and toner products. Over the intervening 30+ years, this situation has changed dramatically. Millions of dollars have been invested globally into technologies for producing high-quality remanufactured and new-build compatible cartridges. No longer does a consumer have to rely exclusively on high-priced OEM brand cartridges to replenish its printers. Original Equipment Manufacturers Anyone familiar with the OEM managed print programs may already know that the OEMs provide aftermarket printer cartridges to fulfill their contract obligations on third-party equipment under their management. Clearly, for example, if an OEM such as Lexmark wins a managed print account that includes non-Lexmark equipment (i.e. HP), then they're not going to go to HP to try and buy original brand HP cartridges. Instead, they (Lexmark) go to a reputable aftermarket manufacturer and purchase aftermarket cartridges to fit on the HP machines. This type of practice, although not widely publicized, adds additional credibility to high-quality aftermarket ink & toner products available from reputable manufacturers. Consumer Purchasing Habits Today's consumers have access to far more information than they did 30 years ago and many have become comfortable making informed decisions with regards to less expensive third-party product offerings than they used to be. The trade-off, in terms accepting reduced quality for a reduced price is no longer required, with the performance of aftermarket products manufactured by reputable aftermarket suppliers being virtually indistinguishable from that of the original brand products. Some Conclusions Aftermarket brands have gained traction in many other industries including pharmaceuticals, auto parts, and food products. Consumers have demonstrated they're prepared to ingest private label medicines and private label food products, and they've demonstrated they're prepared to repair their automobiles with aftermarket parts. After more than thirty-years of ink and laser printing, most still currently elect to spend more than 17 times the initial investment required to acquire their printing equipment, on the supplies required to run them over a 4-year period. For informed consumers who decide to replenish their printing equipment with high-quality aftermarket alternatives, the TCO can be reduced by nearly 40% and the ratio of the initial investment to TCO reduced from 17 to around 10! Introducing aftermarket ink and toner products as an alternative to high-priced OEM brand cartridges results in cost savings and an overall improvement of the managed spend. This, in turn, can form a significant component of the overall transformation from a traditional to a digital office.

10 Comments

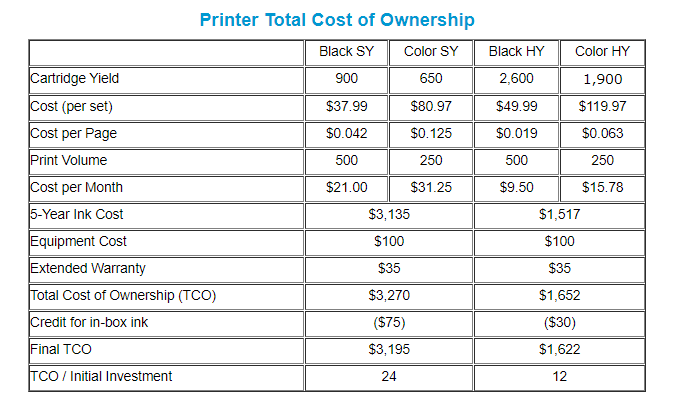

It's not too difficult to understand why original brand (OEM) ink and toner cartridges are so expensive. There are many similar business models outside the office products industry where a piece of platform equipment is sold to a consumer at a low cost and the manufacturer then generates an ongoing, very profitable revenue stream selling consumables for the equipment. The equipment cannot continue to be used without replacement consumables because the supplies provided with the initial purchase will soon be depleted. Unless replacement consumables are then purchased, the initial investment becomes worthless. In order for the manufacturer of the platform equipment to be successful, it must maximize placements (sales) of its equipment. In order to accomplish this goal, it usually decides to set the sell price as low as possible because more consumers are inclined to purchase a low-priced product than a high-priced product. The more devices sold, the larger the installed base becomes and the greater the manufacturers potential for generating profits on the sale of replacement consumables. Manufacturers deploying business models like this may sell the platform unit below its actual cost with the expectation that initial losses will be recovered through the future sale of replacement consumables. Furthermore, if the manufacturer is the only supplier of replacement consumables designed to fit in the platform device, a relatively high selling price can be set for them because the manufacturer knows the consumer doesn't have alternatives. Most consumers tend to overlook the calculations needed to determine the total cost of ownership associated with a new device. In order for them to do so, the total cost calculation must include the initial outlay on the device, the cost of consumables for the expected lifetime, and the cost of any extended service or repair warranties. Let's consider a desktop ink jet printer like the Epson Workforce Pro WF-4720. It can be purchased for around $100, a two-year extended warranty can be purchased for an additional $35, and the printer comes with a set of starter cartridges. Let's also assume the buyer expects the device to last for five years and will be printing an average of 500 monochrome and 250 color pages per month. The upfront investment required to obtain this device (including a 2-year extended warranty) is a modest $135 but, it will only be 54 days before the black ink cartridge runs out and only 24 days after that before the color cartridges also run out. At those time points the customer must then go back into the market to purchase replacements ink cartridges. The consumer should be diligent because Epson makes two different cartridge styles available for this particular printing device; standard yield and high yield versions which result in a large difference in the operating costs. Anyone who's prepared to do some mental arithmetic can quickly determine the high-yield cartridges have the lowest printing cost per page and this metric is what determines the total cost of ownership over the expected 5-year lifespan. What can be seen from this analysis is that the total cost of ownership can vary by almost 100% depending on the style of cartridges chosen.

Let's think a moment about the buyer's psychology when considering the purchase of replacement cartridges. Remember, the upfront investment was $135 and the first set of replacement cartridges will cost $120 if the buyer selects standard yield versions and $170 if they're high-yield. It's tough for consumers to get their heads around having to spend more than the original device cost just to obtain a replacement set of cartridges. Because of this, fewer are usually prepared to shell out $170 for the High Yield (HY) cartridges than $120 for the Standard Yield (SY) versions, which must also mean the math to calculate the cost per page isn't generally being done. Over the planned five-year lifespan, the cost of this oversight adds up and results in more than 24-times the initial investment in the printer being spent on replacement cartridges. However, for the consumer who does do the math and overcomes the psychological barrier for spending almost twice the initial investment on their first set of replacement cartridges, and then continues to do for the lifetime of the printer, the total cost of ownership is halved to 12-times the initial investment. This is still a significant spend but only 50% of what it would otherwise have been. Conclusions: Think about how the decision was initially arrived at to purchase this particular device. Most likely the modest initial investment of $135 was a primary consideration but it's also likely that, while attracted by the low entry cost, not much thought was given to figure out the total cost of ownership. Furthermore, because it's quite difficult (and therefore rare) to calculate the total cost of ownership, it's also rare to be in a position to compare the preferred device with alternatives and, therefore, it's also rare that a fully informed decision can be made on the basis of lifetime costs. For example, what if there were an alternative $235 printing device, that met the customer's requirements, but it came with cartridges that had 30% lower costs per printed page? The extra $100 investment in the printer would be more than offset with lifetime savings of $1,000 on SY cartridges, or $500 on HY cartridges. Unfortunately, not many consumers do this math so they cannot understand spending 50% more at the outset could save over 30% on the total cost of ownership. As we've seen, printing in the office or home can become quite an expense. In our example, the printer is expected to output 45,000 pages over its lifetime, a percentage of which will be trashed and the remainder of which will be filed away and, in most cases, never looked at again. For a business really looking to understand its total cost of ownership, it's not just the cost to print all the pages, it's also the cost of the resources required to file, and then potentially retrieve, a portion of those documents needed at a later time for some reason. Finally, it's really important, when considering a new printing device investment to make sure the machine is correctly "sized" for its purpose. There's no need to over-invest in a device with a work cycle of say 20,000 pages per month, when the maximum demand expected to be placed on it is 5,000 pages per month. Over-specifying increases the upfront costs and increases the total cost of ownership. Focusing on making the most informed decision with regards to selecting the optimal printing device for your requirements forms an important element of the transformation from a Traditional to a Digital Office environment. There are significant potential savings to take advantage of that come hand-in-hand with a successful transformation. |

Guy Brown LLC | 7111 Commerce Way | Brentwood, TN 37027 | 800-575-8999 | [email protected]

About Us | Careers | Free Cartridge Recycling | EEO Statement

About Us | Careers | Free Cartridge Recycling | EEO Statement

Guy Brown is an award-winning, certified Minority Business Enterprise (MBE).

Copyright © 2024 Guy Brown LLC. All trademarks and trade names are property of their respective owners.

Copyright © 2024 Guy Brown LLC. All trademarks and trade names are property of their respective owners.

RSS Feed

RSS Feed